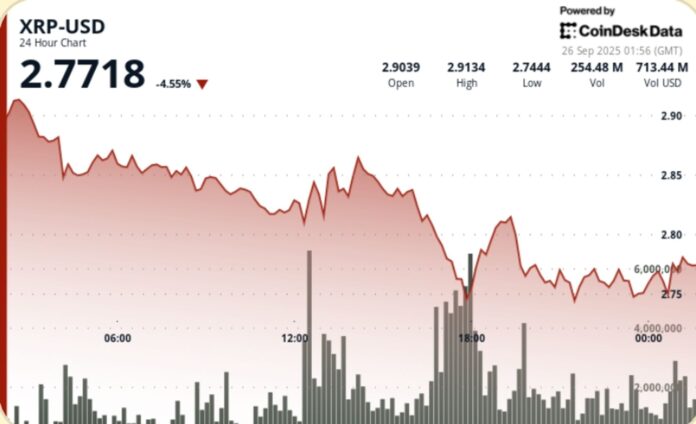

The token has lost $19 billion in value over seven days as resistance at $2.80 hardens.

Updated Sep 26, 2025, 2:13 a.m. Published Sep 26, 2025, 2:12 a.m.

XRP’s push above $2.90 collapsed under heavy selling on Sept. 25, with a $277 million volume spike hammering price back to $2.75.

The move erased more than $18 billion in market value over the past week and confirmed fresh resistance at $2.80, leaving traders bracing for a test of $2.70 support.

News Background

• XRP slid 5.83% over the Sept. 25–26 session, falling from $2.92 to $2.75 on heavy institutional selling.

• A sharp rejection at $2.80 during the 17:00 hour triggered a 276.77 million volume spike — more than 2.5x the 24-hour average.

• Despite SEC approval of the first U.S. XRP ETF, optimism has been offset by Powell’s warnings on valuations and rising Treasury yields.

• Over the past week, XRP’s market value has contracted by $18.94 billion, down 10.22%, breaking below the $3.00 psychological threshold.

Price Action Summary

XRP traded between $2.92 and $2.74 — a 6.3% intraday range — before closing near $2.75.

• Sellers dominated after $2.80 rejection on extreme volume, creating a distribution zone that capped further upside.

• Subsequent recovery attempts stalled around $2.81–$2.82, confirming fresh resistance clusters.

• Final hour saw a brief 1.09% bounce from $2.75 to $2.78, driven by concentrated flows between 00:50–00:57 on volumes above 3 million per candle.

• Short-term support is now seen at $2.75–$2.77, with downside risk toward $2.70 if breached.

Technical Analysis

• Range: $0.18 (6.3%) between $2.92 high and $2.74 low.

• Resistance: $2.80 initial rejection; $2.81–$2.82 clusters formed on failed retests.

• Support: $2.75 zone defended in late session; $2.70 psychological level next watch.

• Volume: 276.77M at 17:00 vs. 108.42M daily average.

• Pattern: High-volume rejection signals distribution. Short-term consolidation near $2.77 suggests indecision before next move.

What Traders Are Watching

• Whether $2.75 holds through Asia session or breaks toward $2.70.

• ETF optimism versus real money outflows — sell-the-news pattern remains in play.

• Whale flows after $800M in transfers over past week; positioning risk if selling resumes.

• Macro overhang: Powell’s hawkish tone, Treasury yields climbing, Fed cut expectations capped.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Dubai Royal-Backed Fund MGX Buys 15% of TikTok U.S. Business in Major Stake Deal: Report

MGX, which previously bought $2 billion of World Liberty Financial’s USD1, and Oracle will control nearly half of TikTok’s U.S. arm as American firms secure majority ownership.

What to know:

- MGX, chaired by Sheikh Tahnoon bin Zayed Al Nahyan, will take a 15% stake in TikTok U.S.

- Oracle and MGX together will hold about 45% of the U.S. unit.

- MGX previously bought $2 billion worth of USD1, a stablecoin launched by the Donald Trump-linked World Liberty Financial.