Bitcoin Miner Hut 8 Surges 10% on 1.5GW Expansion Plans

Investment bank Roth Capital said the move had the potential to “materially re-rate the stock.”

Aug 26, 2025, 4:16 p.m.

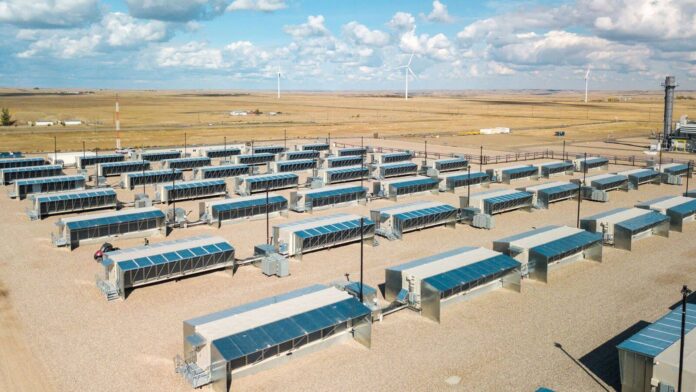

Hut 8 (HUT), a public bitcoin BTC$112,185.01 mining and energy infrastructure firm, surged Tuesday after revealing plans to more than double the company’s power capacity.

The plans include the development of four new sites across the United States with more than 1.5 gigawatts (GW), expanding total power capacity to over $2.5 GW across 19 locations, according to a press release.

The stock rose more than 10%, hitting a seven-month high just shy of $26 per share even as bitcoin prices remain stuck in the doldrums below $110,000.

Data center firms are enjoying renewed investor interest as demand for computing power soars to fuel artificial intelligence innovation. Recently, tech giant Google took a minority stake in bitcoin miner TeraWulf as part of a $3.2 billion AI infrastructure deal.

“This expansion marks a defining step in Hut 8’s evolution into one of the largest energy and digital infrastructure platforms in the world,” Hut 8 CEO Asher Genoot said in the press release.

The company said it has reclassified the projects from “exclusivity” to “development,” meaning it has secured land and power deals and is working on design and commercialization.

To finance the projects, the firm plans to draw in up to $$2.4 billion in liquidity from various sources. That includes borrowing against its 10,000 BTC stash worth roughly $1.1 billion, a $200 million revolving credit line, an expanded $130 million facility from Coinbase and a recently launched $1 billion at-the-market equity offering.

Investment bank Roth Capital viewed the expansion plans as a “notable step-up,” with potential to “materially re-rate the stock” as the sites come online and get contracted for AI and high-performance computing.

Read more: Bitcoin Mining Faces ‘Incredibly Difficult’ Market as Power Becomes the Real Currency

Krisztian Sandor

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.

More For You

Finastra Taps Circle to Bring USDC Settlement to $5T Global Cross-Border Payments

Integrating USDC into Finastra’s payments hub aims to cut costs and speed up international transfers.

What to know:

- Finastra will integrate Circle’s USDC stablecoin into its payments hub, allowing banks to settle cross-border transfers with the token.

- The integration starts with Finastra’s Global PAYplus, which processes $5 trillion daily flows, aims to reduce reliance on costly correspondent networks by enabling faster and cheaper settlements.

- The move highlights the growing interest in stablecoins among financial institutions as alternatives to traditional settlement methods.