AVAX tumbled alongside the rest of the crypto market, extending a weeklong slide despite Anthony Scaramucci-backed AVAX One’s rebrand.

Sep 26, 2025, 4:12 p.m.

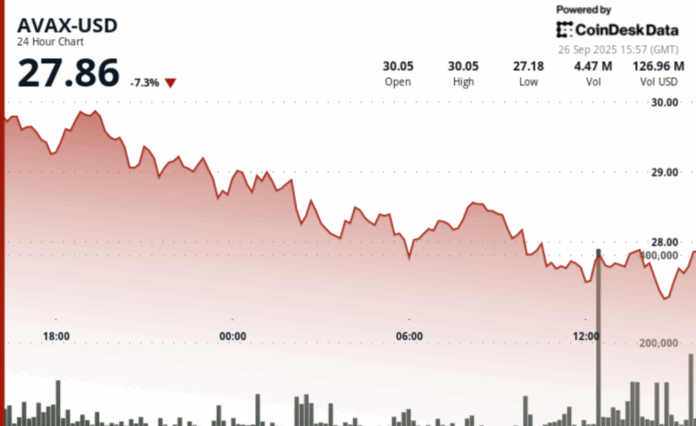

Avalanche’s native token AVAX fell 8% over the past 24 hours to $27.72, extending a weeklong slide that erased nearly 18% of its value. The drop occurred alongside a broad plunge in crypto markets that’s seen ETH, SOL, DOGE also post double-digit percentage declines over the past week and BTC fall 6%.

AVAX has struggled to break above a resistance level of $30.28 and found only weak support near $27.65. CoinDesk Analytics data shows trading volume sank to 121,896 tokens in early trading Friday, signaling that institutional selling may be slowing but has not yet reversed.

The price slump comes in the wake of Avalanche-aligned corporate initiatives aimed at deepening institutional engagement. Earlier this week, tech company AgriFORCE Growing Systems rebranded as AVAX One and announce plans to raise $550 million to acquire and hold AVAX. The move would make it the first Nasdaq-listed company to focus exclusively on Avalanche’s ecosystem.

The firm assembled a high-profile advisory team led by SkyBridge Capital founder Anthony Scaramucci and Coinbase Institutional’s Brett Tejpaul, positioning itself as a major AVAX custodian. AVAX One aims to hold more than $700 million in the token, a bid to cement its role as a central figure in Avalanche’s growth story.

But for now, the market hasn’t bought in.

The falling price suggests that institutional backers may still be cautious about Avalanche’s long-term positioning. While regulatory approvals for token-related vehicles are pending, they have yet to translate into buying momentum.

Avalanche’s roadmap includes partnerships and enterprise use cases, but these fundamentals have yet to counterbalance the current selling pressure.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Crypto Treasury Firms Could Become Long-Term Giants like Berkshire Hathaway, Analyst Says

Ryan Watkins argues crypto treasury firms may evolve beyond speculation into lasting economic engines, deploying capital and building businesses across ecosystems.

What to know:

- Ryan Watkins of Syncracy Capital says Digital Asset Treasury (DAT) firms hold $105B in crypto and could evolve into long-term ecosystem players.

- Unlike foundations, Watkins sees successful DATs using their assets to operate businesses, fund growth, and even influence governance.

- He likens their potential to giants such as Berkshire Hathaway, but warns only well-managed DATs will endure beyond today’s speculative phase.