XLM fell 3.58% to $0.39 on heavy institutional selling, but fresh corporate partnerships and stablecoin integrations highlight Stellar’s long-term growth prospects.

Updated Sep 19, 2025, 4:31 p.m. Published Sep 19, 2025, 4:31 p.m.

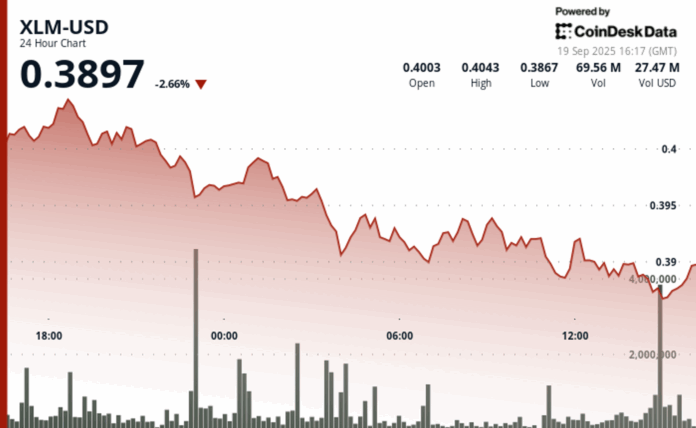

Stellar’s XLM token slipped below key support in a bout of institutional selling, signaling broader market weakness. Between Sept. 18 at 15:00 and Sept. 19 at 14:00, XLM fell 3.58% from $0.40 to $0.39, with volumes surpassing the 24-hour average of 22.33 million tokens. Analysts pointed to concentrated selling during overnight sessions — traditionally dominated by institutional flows — and the breach of $0.40 support as evidence of repositioning ahead of regulatory clarity.

Despite the pullback, XLM found modest relief in the final hour of trading, eking out a 0.05% gain as buyers defended the $0.39 level. Still, the broader trend remains bearish, with resistance consolidating around the $0.40 threshold where previous rebounds have faltered on elevated volume. Technical analysts warned the pattern of lower highs signals persistent downside pressure.

At the same time, institutional interest in Stellar’s infrastructure continues to grow. The Stellar Development Foundation highlighted adoption during its Meridian conference in Rio de Janeiro, where Centrifuge deployed a $20 million tokenized real-world assets (deRWA) initiative and Mercado Bitcoin announced a $200 million tokenization program. PayPal’s USD stablecoin also went live on Stellar, extending institutional access to the network.

Market Indicators Reflect Institutional Repositioning

- XLM breached critical support at $0.40 with trading volumes exceeding 22.33 million average.

- Clear bearish trend established with lower highs formation throughout the trading session.

- Resistance levels consolidated at $0.40-$0.40 where recovery attempts faced institutional rejection.

- Intraday volatility reached $0.003 range between $0.39 session peak and $0.39 trough.

- Volume surge to 1.13 million units during selling pressure before institutional stabilization.

- Recovery momentum emerged with 0.05% gain in final 60 minutes of trading activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Michael Saylor: Bitcoin Is Building a Base as ‘OG’ Hodlers Exit and Big Money Preps

Saylor says bitcoin’s volatility is easing as early holders cash out, clearing the way for institutions to step in and build a stronger market base.

What to know:

- Michael Saylor said bitcoin’s sideways trading reflects “OG” holders cashing out while institutions wait for lower volatility.

- He argued that bitcoin’s lack of cash flows is a feature, comparing it to gold and other stores of value.

- Strategy (formerly MicroStrategy) has created new bitcoin-backed credit products designed to give the asset cash-flow-like qualities.

Жiнка https://zhinka.in.ua блог для женщин. Мода, уход, фигура, советы хозяйкам и мамам.