XLM trades in a tight range with strong support at $0.42 as record wallet growth and rising total value locked fuel optimism for a push toward the $0.50 resistance — and potentially beyond.

Aug 15, 2025, 3:35 p.m.

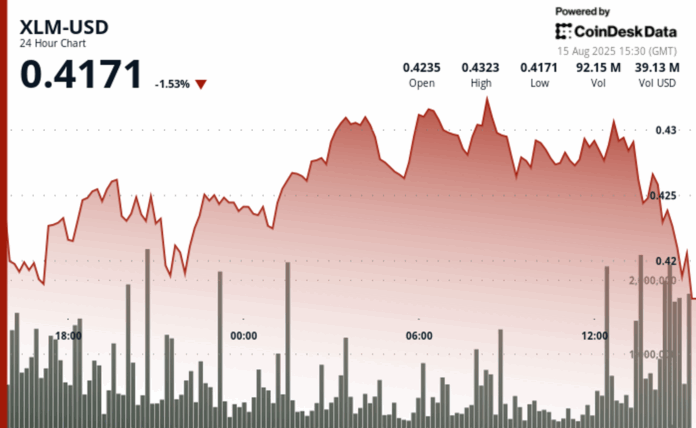

Stellar lumens (XLM) traded in a tight range over the past 24 hours, holding between $0.42 and $0.43 from Aug. 14 at 15:00 UTC through Aug. 15 at 14:00 UTC.

The token saw measured gains before late-session profit-taking pushed prices 1% lower to $0.43 in the final hour of trade. CoinDesk Data’s technical analysis model suggests XLM is approaching a key resistance level at $0.50, with a breakout potentially targeting $0.60–$0.77, backed by strengthening network fundamentals and growing institutional participation.

On-chain metrics continue to paint a bullish picture. Stellar’s active enterprise wallets hit an all-time high of 9.69 million, with 5,000–6,000 new institutional addresses added daily.

Total value locked on the network jumped 80% to $150 million, reflecting a surge in corporate adoption. Traders are closely watching the $0.47–$0.50 zone, a potential trigger point for institutional short covering that could fuel the next leg higher.

Despite early pressure pushing XLM down to $0.42 in the first six hours of the session, buyers consistently emerged at that level, signaling strong institutional support.

Overnight, the token staged a steady recovery, retesting $0.43 before consolidating. In the final 60 minutes, heavy selling briefly drove prices back to $0.42, but a swift rebound and lighter volume suggest selling pressure may be easing, leaving room for renewed upside momentum.

Corporate Technical Indicators Signal Consolidation Phase

- Stellar established robust institutional support at $0.42 zone with consistent corporate buyer emergence during early session decline.

- Cryptocurrency tested resistance near $0.43 during overnight institutional trading before consolidating in upper price range.

- Trading volume peaked at 71.43 million during initial six-hour decline, indicating significant institutional participation and interest.

- Technical formation approaches critical resistance at $0.50 level, representing key institutional breakout threshold.

- Corporate momentum indicators suggest potential advancement toward $0.60-$0.77 institutional price target zones.

- Diminishing trading volume in final hour signals exhausted institutional selling pressure and market stabilization potential.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CD Analytics

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Oliver Knight

Oliver Knight is the co-leader of CoinDesk data tokens and data team. Before joining CoinDesk in 2022 Oliver spent three years as the chief reporter at Coin Rivet. He first started investing in bitcoin in 2013 and spent a period of his career working at a market making firm in the UK. He does not currently have any crypto holdings.

More For You

This Is the ‘Best Investment Environment Ever’, Says BlackRock’s CIO of Global Fixed Income

Rick Rieder cited strong earnings, high yields and low volatility as drivers of today’s favorable investing climate, while warning complacency remains a risk.

What to know:

- Rieder said record cash on the sidelines, share buybacks and earnings strength make equities attractive despite lofty valuations.

- He cited fixed-income yields of 6.5%–7% and historically low volatility as key support for investors.

- He expects the Fed to cut rates in September, arguing high policy costs outweigh limited inflation benefits.