Chainlink Partners With SBI Group to Advance Tokenized Assets, Stablecoins in Japan

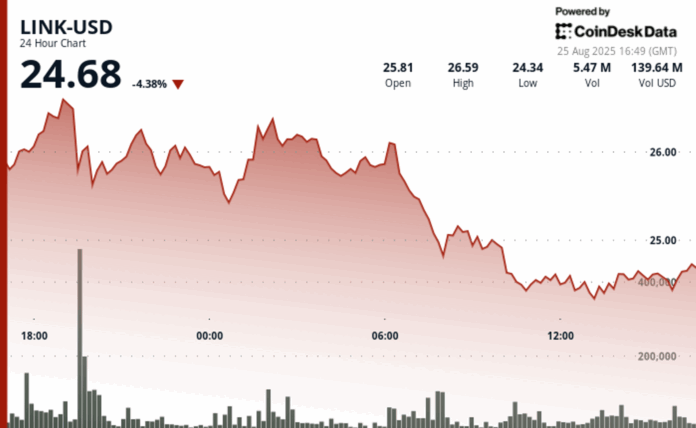

Despite the major partnership, LINK declined 5% over the past 24 hours alongside the broader crypto weakness.

Updated Aug 25, 2025, 6:49 p.m. Published Aug 25, 2025, 5:28 p.m.

Native token of oracle network Chainlink LINK$24.15 declined in tandem with the broader crypto market despite a fresh partnership with Japanese financial giant SBI Group.

LINK declined to $24.4, down more than 6% over the past 24 hours, CoinDesk data shows. That’s a sharp reversal from the Friday’s year-to-date peak over $27.

The downward trajectory accelerated through successive trading sessions with persistent lower peaks, whilst the concluding hour exhibited stagnation with negligible volume, suggesting potential consolidation, according to CoinDesk Research’s technical analysis model.

On the news side, SBI Group, one of Japan’s largest financial conglomerates, said on Monday it has teamed up with Chainlink to develop tokenized assets and stablecoin solutions in Japan, with future plans to expand into other Asia-Pacific markets.

SBI will use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to support transactions across different blockchains while maintaining compliance. The firms will also test tokenized funds by bringing net asset value data on-chain and explore payment-versus-payment settlement for foreign exchange and cross-border transactions. Chainlink’s Proof of Reserve will be used to verify stablecoin reserves.

SBI and Chainlink have previously collaborated under Singapore’s Project Guardian, a Monetary Authority of Singapore (MAS) initiative exploring blockchain use in finance.

Technical Indicators Analysis

- Resistance established at $26.61 with sharp reversal upon elevated volume activity.

- Critical support emerged at $24.37 with purchasing interest.

- Extraordinary volume of 7,850,571 units during peak volatility, substantially exceeding 24-hour average of 2,687,393.

- Systematic lower peak formations indicating bearish momentum acceleration.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Krisztian Sandor

Krisztian Sandor is a U.S. markets reporter focusing on stablecoins, tokenization, real-world assets. He graduated from New York University’s business and economic reporting program before joining CoinDesk. He holds BTC, SOL and ETH.

CD Analytics

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

XRP Futures Set Open Interest Record at CME, With $3.70 Eyed Next

Derivative milestone comes as spot XRP weathers sharp $2.96–$2.84 swing on 217 million volume and institutional flows step back in.

What to know:

- CME Group’s crypto futures suite has surpassed $30 billion in notional open interest, with SOL and XRP futures each crossing $1 billion.

- XRP became the fastest contract to reach $1 billion in notional open interest, achieving this milestone in just over three months.

- Despite regulatory pressures in the U.S., corporate adoption and pilot remittance programs keep XRP in focus, with institutional flows supporting its price action.