BNB’s price action, characterized by continued buying and retests of support levels, suggests potential institutional accumulation.

Aug 12, 2025, 3:17 p.m.

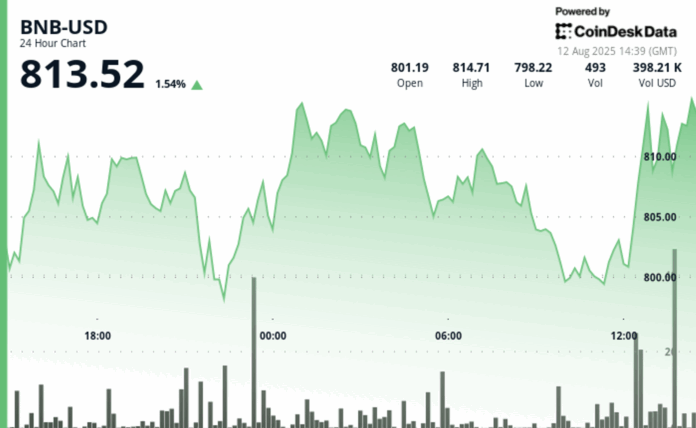

The price of BNB climbed more than 1.5% in the last 24 hours, managing to overcome weakness during the session to move above the $810 mark, up from a low that test its $800 support level.

The cryptocurrency is now targeting the resistance level at $815 after buyers helped push its price further upward through multiple smaller resistance points, according to CoinDesk Research’s technical analysis model.

Ongoing corporate adoption, with CEA Industries recently becoming the largest corporate holder of BNB after a $160 million purchase. Several other companies, including Nano Labs and Windtree Therapeutics, are also moving to establish BNB treasuries.

Technical Analysis Overview

BNB’s trading over the past 24 hours showed the kind of disciplined price action often associated with institutional accumulation.The token traded within a $22.41 range, from a low of $792.47 to a high of $814.88, with buyers stepping in repeatedly at the $800–$803 level.

Those support retests drew consistent volume, suggesting a readiness to defend the zone. Resistance first emerged near $811.71, then again in the $814–$815 area, where algorithmic selling programs added pressure.

The turning point came as BNB built a series of higher lows, $800.44, $801.20, $802.47 and $804.08, steadily absorbing sell orders.

This sequence was followed by the removal of key resistance barriers at $803.50, $807.20 and $809.50, a pattern market technicians view as a sign of sustained buying interest.

A surge in volume at the $800.44 support level sparked a decisive push higher, with a breakout above $804 then occurring. That rally carried the token to intraday highs near $810.57 before settling just below the $815 resistance zone,a level that now stands as the next test for bullish momentum.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CD Analytics

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Francisco Rodrigues

Francisco is a reporter for CoinDesk with a passion for cryptocurrencies and personal finance. Before joining CoinDesk he worked at major financial and crypto publications. He owns bitcoin, ether, solana, and PAXG above CoinDesk’s $1,000 disclosure threshold.

More For You

BONK Jumps 10% to $0.000027 Before Profit-Taking Hits

BONK posts its strongest daily rally in weeks, hitting $0.000027 before selling pressure caps gains.

What to know:

- BONK gained 10% in 24 hours, reaching $0.000027 before some profit-taking brought a small pullback.

- Support held at $0.000024 during early trading, fueling an overnight breakout.

- Volume spikes suggest institutional activity amid heightened volatility.