Support has formed in the $4.61-$4.66 zone with resistance at the $4.72 level.

Aug 8, 2025, 4:49 p.m.

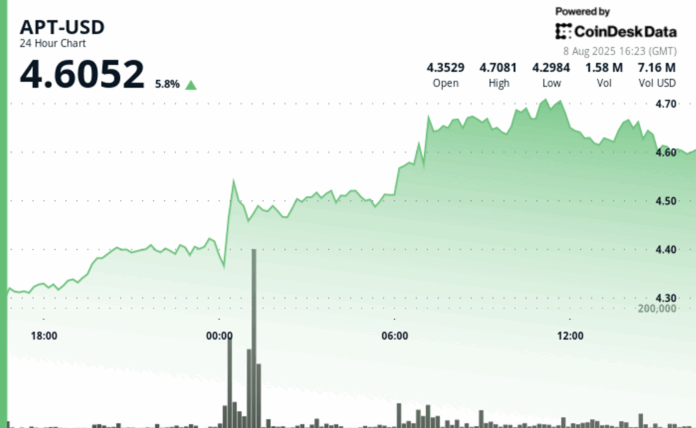

Aptos’ APT registered a 7% surge during the last 24 hours, advancing from $4.34 to $4.62, according to CoinDesk Research’s technical analysis model.

The model showed that Aptos demonstrated considerable bullish momentum throughout the preceding 24-hour period.

The most significant price action materialised during the nocturnal hours extending into the early morning of August 8, wherein exceptional volume surges exceeding 12.9 million units propelled the asset through successive resistance levels, establishing fresh support foundations within the $4.61-$4.66 corridor, according to the model. Resistance has emerged at $4.72

Aptos has surpassed Solana and Stellar in real-world asset (RWA) tokenization, securing third position globally with more than $719 million in RWA total value locked.

The rally in APT came as the wider crypto market also rose, with the broader market gauge, the Coindesk 20, recently up 3.2%.

In recent trading, Aptos was 7% higher over 24 hours, trading around $4.62.

Technical Analysis:

- 24-hour price range of $0.44 encompassing a 9.4% range, with a high at $4.72.

- Volume surges exceeding 12.9 million units during nocturnal hours extending into early morning of Aug. 8.

- Support zone established at $4.61-$4.66 with robust institutional accumulation at $4.36.

- Resistance threshold confirmed at $4.72 with substantial volume-driven rejection pattern.

- Ascending trough formations suggest continued upward pressure towards $4.80-$4.90 Fibonacci levels.

- Terminal hour reversal with 126,000+ volume surge confirming institutional distribution activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

CD Analytics

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

Will Canny

Will Canny is an experienced market reporter with a demonstrated history of working in the financial services industry. He’s now covering the crypto beat as a finance reporter at CoinDesk. He owns more than $1,000 of SOL.

More For You

Trump-Linked World Liberty Seeks $1.5B for Public Crypto Holding Firm: Bloomberg

The move would see World Liberty Financial join other crypto treasury firms, and comes as Trump adopts pro-crypto policies.

What to know:

- World Liberty Financial is said to be in talks to raise $1.5 billion from investors.

- The funds would be used to create a public company that holds WLFI tokens, which are expected to become tradable.

- The move would see World Liberty Financial join other crypto treasury firms, and comes as Trump adopts pro-crypto policies, including allowing 401(k) plans to invest in cryptocurrency.