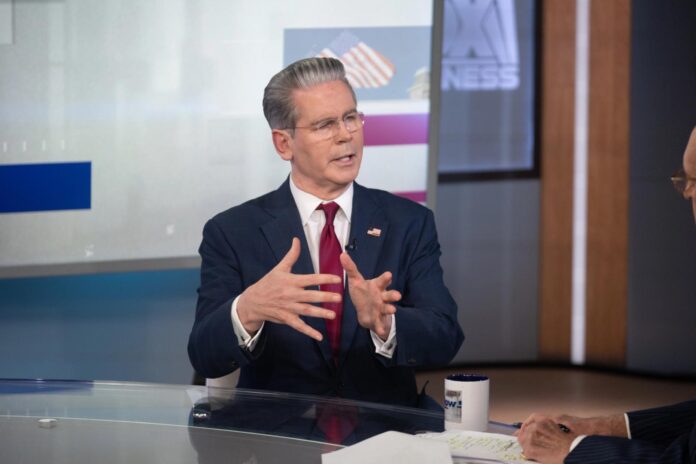

Scott Bessent Suggests Government Bitcoin Purchases Remain a Possibility

The Treasury Secretary’s late-Thursday afternoon tweet seemingly contradicted his statement from earlier in the day.

Updated Aug 15, 2025, 1:23 p.m. Published Aug 14, 2025, 8:40 p.m.

Treasury Secretary Scott Bessent began Thursday by dashing the hopes of at least some bitcoiners, saying the Strategic Bitcoin Reserve would be made up of the $15 billion to $20 billion already held by the government, but that there was no intention of making any fresh purchases.

He ended the day, however, by seemingly contradicting those remarks, saying his department is “committed to exploring budget-neutral pathways to acquire more Bitcoin to expand the reserve.”

The fresh buys would be in addition to tokens forfeited to the government, which will be the “foundation” of the reserve, Bessent said.

U.S. President Donald Trump signed an executive order in March to create a strategic bitcoin reserve which Bessent has advocated for. Earlier this month, Bo Hines, the leader of the White House’s Council of Advisors on Digital Assets — whose tasks, among other things, included the SBR — exited his position.

Bitcoin

continued to trade at about $118,000 late in the U.S. afternoon Thursday, down sharply since hitting a new record high of $124,000 just hours earlier.

The bulk of the decline came after a far stronger than anticipated Producer Price Index report, which called into question the idea that inflation is receding enough for the Federal Reserve to trim interest rates in September.

Helene Braun

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

More For You

Digital Asset Treasury Firms Plunge as Bitcoin Tumbles Below $117K, ETH Slides to $4.4K

The crypto rally continues to quickly reverse course just two days after bitcoin surged to a new record and ether soared to a five-year high.

What to know:

- Digital asset treasury firms experienced significant sell-offs as the crypto rally lost momentum.

- Strategy (MSTR) fell 3%, down 33% from its November 2024 high. Ether-focused BMNR, SBET posted bigger losses.

- The move coincided with bitcoin and ether sharply reversing from big moves higher less than two days ago.