Bitcoin Profit Taking Appears Modest Even Near All-Time High

Glassnode data shows long-term holders driving realized profits, while overall selling remains subdued, signaling potential for further gains.

Aug 12, 2025, 2:53 p.m.

Over the past five days, bitcoin

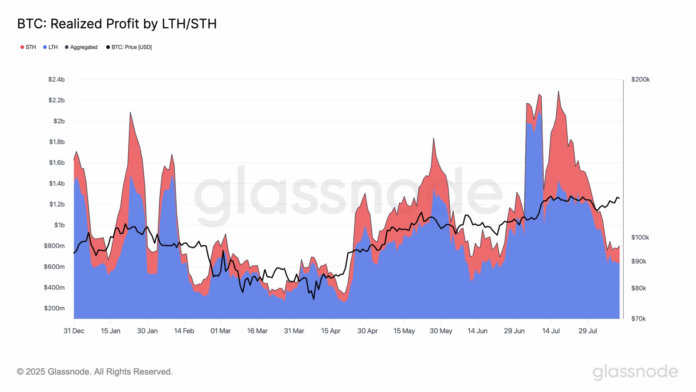

has surged from $116,000 to just above $122,000 before retreating to the current $119,000. Despite this price movement, profit-taking has remained muted, averaging under $750 million per day on a year-to-date basis.

For perspective, Glassnode data shows that in January daily realized profits were around $2 billion, with similar spikes in July when bitcoin reached its all-time high of $123,000.

Glassnode’s Realized Profit metric measures the total profit from all spent coins where the sale price exceeded the acquisition price. When broken down by Long-Term Holders (LTH) and Short-Term Holders (STH), it offers a more granular view of market behavior. This classification is based on the weighted average acquisition date, with LTH supply defined as holdings aged more than roughly 155 days.

The data reveals that LTHs have consistently realized far more profit than STHs. An exception occurred in July, when STH realized profits spiked as bitcoin hit its all-time high. Many of these short-term gains likely came from investors who bought during the March “tariff tantrum” sell-off, when bitcoin fell to $76,000.

The current low level of realized profit-taking, particularly compared with prior market peaks, is encouraging for bitcoin’s bullish outlook. It suggests that holders, both long and short term, are largely refraining from locking in gains despite recent price increases. If this trend persists, it could provide the market with the stability and momentum needed to push toward new all-time highs.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

James Van Straten

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin and Strategy (MSTR).

AI Boost

“AI Boost” indicates a generative text tool, typically an AI chatbot, contributed to the article. In each and every case, the article was edited, fact-checked and published by a human. Read more about CoinDesk’s AI Policy.

More For You

BONK Jumps 10% to $0.000027 Before Profit-Taking Hits

BONK posts its strongest daily rally in weeks, hitting $0.000027 before selling pressure caps gains.

What to know:

- BONK gained 10% in 24 hours, reaching $0.000027 before some profit-taking brought a small pullback.

- Support held at $0.000024 during early trading, fueling an overnight breakout.

- Volume spikes suggest institutional activity amid heightened volatility.