Sygnum and Amina banks have added SUI trading, custody and lending products for professional investors.

Aug 8, 2025, 7:19 p.m.

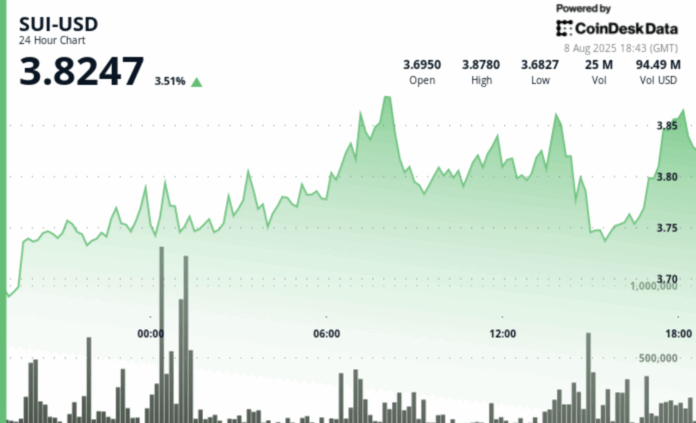

Sui’s (SUI) price rose 4% in the past 24 hours to $3.82 as Swiss digital asset bank Sygnum expanded its offerings to include custody, trading and lending products tied to the blockchain for its institutional clients.

The move means regulated investors in Switzerland can now hold, trade and borrow against SUI through Sygnum’s platform, broadening access to the layer-1 blockchain’s ecosystem. The bank’s services are aimed at professional and institutional investors seeking exposure under Swiss financial regulations.

Earlier this week, another Swiss institution, Amina Bank, said it had started offering both trading and custodial services for SUI. Amina described the step as making it the first regulated bank globally to support the blockchain’s native asset.

The announcements appear to have spurred market activity. CoinDesk Analytics data shows trading volume spiked to 36.45 million tokens over midnight, more than double the 14.31 million daily average, as buyers stepped in to defend a support zone between $3.72 and $3.74. That level has held since mid-July, suggesting short-term traders see it as a key price floor.

SUI’s daily gains track closely with the broader crypto market, as measured by the CoinDesk 20 Index , which climbed 4.5% in the past day. The token’s monthly performance is also positive, up 7% over the past 30 days, but significantly lower than the broader market, with the CD20 up 24%.

For institutional clients, the expansion of regulated access to newer blockchain projects like Sui represents more than just another trading option. It signals growing comfort among banks with integrating blockchain networks beyond the largest, most established assets. In practice, this could mean asset managers, corporate treasuries and high-net-worth clients have more ways to diversify holdings without leaving regulated frameworks.

Sui, developed by Mysten Labs, aims to offer high-speed, low-cost transactions using a novel data structure called “objects” to improve scalability. Wider access through banks like Sygnum and Amina could help it compete for developer attention and real-world applications.

If demand for bank-mediated blockchain exposure continues to grow, Sui may find itself in a stronger position to attract not only speculative traders but also enterprise adoption.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Helene Braun

Helene is a New York-based markets reporter at CoinDesk, covering the latest news from Wall Street, the rise of the spot bitcoin exchange-traded funds and updates on crypto markets. She is a graduate of New York University’s business and economic reporting program and has appeared on CBS News, YahooFinance and Nasdaq TradeTalks. She holds BTC and ETH.

CD Analytics

CoinDesk Analytics is CoinDesk’s AI-powered tool that, with the help of human reporters, generates market data analysis, price movement reports, and financial content focused on cryptocurrency and blockchain markets.

All content produced by CoinDesk Analytics is undergoes human editing by CoinDesk’s editorial team before publication. The tool synthesizes market data and information from CoinDesk Data and other sources to create timely market reports, with all external sources clearly attributed within each article.

CoinDesk Analytics operates under CoinDesk’s AI content guidelines, which prioritize accuracy, transparency, and editorial oversight. Learn more about CoinDesk’s approach to AI-generated content in our AI policy.

More For You

Trump-Linked World Liberty Seeks $1.5B for Public Crypto Holding Firm: Bloomberg

The move would see World Liberty Financial join other crypto treasury firms, and comes as Trump adopts pro-crypto policies.

What to know:

- World Liberty Financial is said to be in talks to raise $1.5 billion from investors.

- The funds would be used to create a public company that holds WLFI tokens, which are expected to become tradable.

- The move would see World Liberty Financial join other crypto treasury firms, and comes as Trump adopts pro-crypto policies, including allowing 401(k) plans to invest in cryptocurrency.