HBAR Faces Sharp Selloff as Technical Breakdown Deepens Bearish Trend

Hedera’s native token slid 3.6% over 23 hours, with heavy institutional selling pushing prices below key support levels ahead of a potential SEC ETF decision.

Updated Oct 3, 2025, 4:18 p.m. Published Oct 3, 2025, 4:18 p.m.

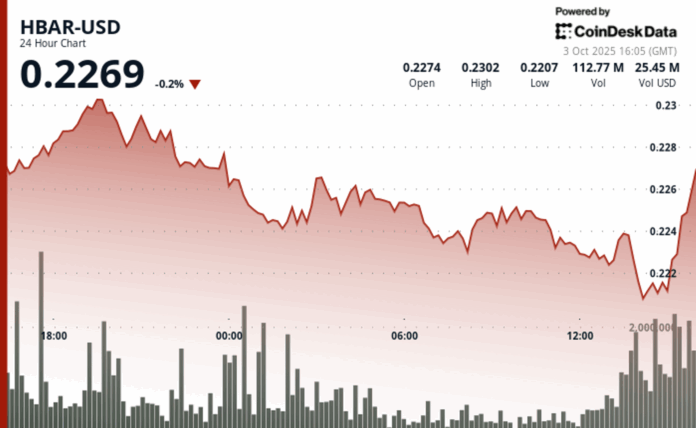

HBAR saw sharp selling pressure on Oct. 3, with momentum intensifying in the final hour of trading. After briefly reaching $0.224, the token fell to $0.222, breaching key support and ending the session down 0.9%.

The steepest drop came between 13:50 and 14:00, when volumes spiked above 3 million, signaling institutional distribution and panic-driven selling. Repeated failures to reclaim $0.224 leave HBAR vulnerable to further downside toward $0.220.

Across the broader 23-hour period from October 2 to 3, HBAR dropped 3.6% from $0.23 to $0.22 on surging volume of 51.3 million, underscoring heavy institutional participation in the selloff.

Despite near-term weakness, attention remains on a potential SEC decision in November on spot crypto ETFs. With backing from governing council members like Google and IBM, Hedera could benefit from regulatory approval even as its technicals point to ongoing pressure.

Technical Metrics Indicate Ongoing Weakness

- HBAR formed a distinct downward trajectory following its peak at $0.23 on 2 October 19:00, with resistance developing at the $0.23 threshold where prices repeatedly reversed lower during multiple trading sessions.

- Essential support developed at $0.23 around midnight on 3 October, followed by an additional support area near $0.22, although both thresholds demonstrated vulnerability under continuous selling momentum.

- Trading volume characteristics revealed elevated activity throughout the initial decline and subsequently during the 13:00 session on 3 October with 51.3 million in volume, indicating institutional engagement in the bearish movement.

- Technical deterioration intensified during the final hour as HBAR struggled to maintain recovery efforts above $0.22 resistance threshold, validating the breach of essential support thresholds.

- Substantial volume surges exceeding 3 million and 2.5 million during the 13:50-14:00 window coincided with intense selling activity, demonstrating institutional distribution and fear-driven selling.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

LINK Shifts Momentum as Stablecoin Chain Plasma Integrates Chainlink Services

Chainlink will provide oracle, cross-chain and data services to the Plasma network to support stablecoin use cases.

What to know:

- Chainlink’s native token (LINK) saw a 6.7% increase this week despite Friday’s pullback, bolstered by institutional and protocol adoption.

- Plasma has integrated Chainlink’s services to support stablecoin payments on its blockchain.

- Swiss bank UBS is piloting Chainlink’s CCIP protocol with SWIFT for tokenized fund operations, signaling growing institutional interest.