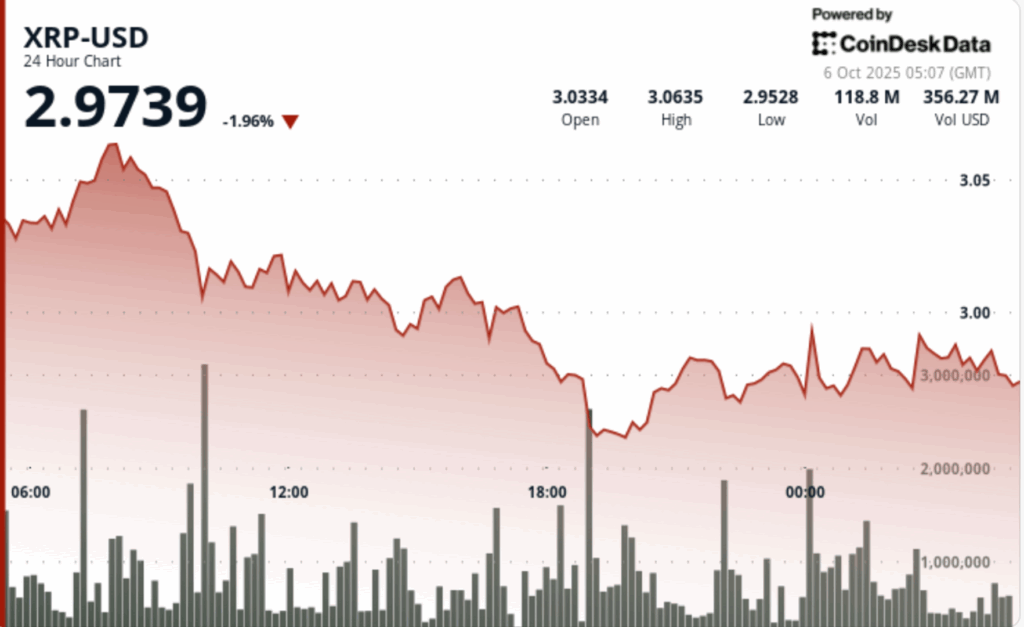

Institutional prints confirmed $3.07 as resistance, while repeated defenses near $2.98 kept losses contained.

Updated Oct 6, 2025, 5:15 a.m. Published Oct 6, 2025, 5:15 a.m.

XRP’s early rally into $3.07 met heavy distribution on elevated volume, leaving a high-volume ceiling intact and pulling price back to $2.98. Institutional prints confirmed $3.07 as resistance, while repeated defenses near $2.98 kept losses contained.

News Background

XRP slipped 1% from Oct. 5, 03:00 to Oct. 6, 02:00, retreating from $3.01 to $2.98 despite opening strength.

The token spiked to $3.07 in early hours, only to face concentrated selling pressure.

Analysts said institutional desks were active at resistance, with turnover 17% above daily averages. Despite bearish control through much of the session, XRP ended with a rebound off $2.98, signaling continued accumulation interest.

Price Action Summary

- XRP traded a $0.09 corridor, or 3% intraday range, between $2.98 and $3.07.

- Price peaked at $3.07 before sharp rejection on 64.3M tokens, vs. 54.7M average.

- Selling pressure dragged XRP to $2.98, where support was repeatedly defended.

- A late-session dip triggered a 1.95M-volume flush to $2.979, immediately absorbed by buyers.

- Rebound flows stabilized price near $2.98, with recovery volumes averaging 750K per bar.

Technical Analysis

- Resistance is firmly established at $3.07, validated by above-average selling pressure and repeated failures to break higher. Support holds at $2.98, where buyers consistently stepped in, including a high-volume flush absorbed late in the session.

- Price action reflects a rejection-driven pullback inside a $3.07–$2.98 band. While sellers dominated two-thirds of the session, the defense of $2.98 shows institutions continue to accumulate on dips, keeping the structure intact for another attempt higher.

What Traders Are Watching?

- Whether $2.98 holds as support in coming sessions.

- If $3.07 remains a hard ceiling or weakens under renewed pressure.

- Signs of sustained institutional inflows as ETF catalysts approach.

- Potential test of $3.10 if buyers can reclaim control above $3.03.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Figure Gets Mixed Wall Street Debut as KBW, BofA Diverge on Outlook

The newly public blockchain lender earns praise for market share in tokenized credit, but concerns remain over scaling and regulation.

What to know:

- KBW initiated coverage of Figure with an “Outperform” rating, citing dominance in tokenized credit markets and upside beyond HELOCs.

- Bank of America issued a “Neutral” rating, pointing to execution risks and overreliance on Figure’s non-blockchain-native HELOC business.

- The $7.50 gap in price targets highlights cautious expectations around Figure’s ability to scale its blockchain lending platform.