This Trend Has Marked Local Tops in Bitcoin, but This Time May Be Different

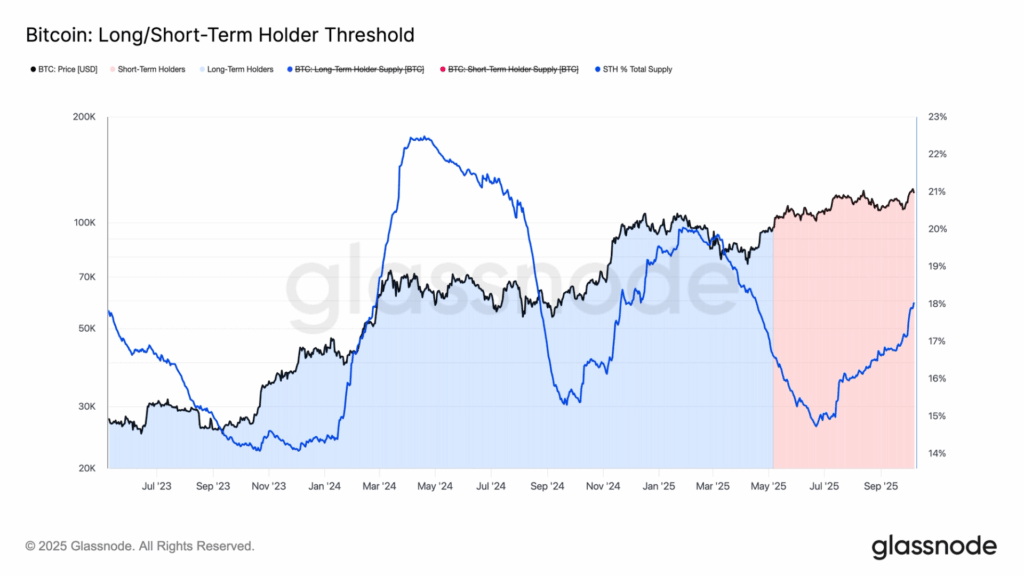

Despite increasing by 450,000 BTC since July, short-term holders remain below prior highs, signaling tempered market sentiment.

Oct 8, 2025, 3:45 p.m.

Short-term holders (STHs) have added roughly 450,000 BTC to their supply since July, now holding around 2.6 million BTC according to Glassnode data.

STHs are defined as investors who purchased bitcoin within the past 155 days.

This increase marks the third distinct cycle of rising STH activity since the start of 2024 and has typically marks a local top in the bitcoin price.

The first peak occurred in April 2024, shortly after bitcoin’s March all-time high of $73,000.

The second peak came in January 2025, aligning with the $110,000 all-time high, and the latest so far, the third peak has followed a new record of $126,000.

Each successive cycle has seen a smaller STH cohort, suggesting that overall market euphoria and speculative behavior are gradually fading.

Across these three peaks, STH supply as a share of total circulating supply has declined from 22% to 20%, and now sits at roughly 18%, according to Glassnode data.

Earlier in Q1 2025, STHs held as much as 2.8 million BTC, but their supply fell to around 2.1 million BTC as bitcoin declined to $76,000. This indicates that STHs were a major driver of the selling pressure seen in April.

In contrast, long-term holders (the inverse of STHs) started to reduce their position over the summer months, distributing roughly 250,000 BTC since July as bitcoin consolidated, now holding 14.5 million BTC.

As Bitcoin enters its historically strongest period of the quarter, the expectation is STH supply will continue to increase and make new cycle highs to over 3 million BTC.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Pantera Backs TransCrypts with $15M Seed Round to Expand Blockchain Identity Platform

The funds will be used to expand the company’s credential verification system beyond employment into healthcare and education.

What to know:

- Pantera Capital has led a $15 million seed round for TransCrypts, joined by Lightspeed Faction, Alpha Edison, and other investors.

- The company plans to extend its blockchain credential platform to health and education records following its HIPAA certification.

- TransCrypts recently won CoinDesk’s Pitchfest at Consensus Hong Kong, earning $10,000 in tokens, a trophy, and ten mentoring sessions.