XLM climbed back above $0.39 after a brief sell-off, with rising open interest signaling renewed institutional confidence.

Updated Oct 8, 2025, 4:08 p.m. Published Oct 8, 2025, 4:08 p.m.

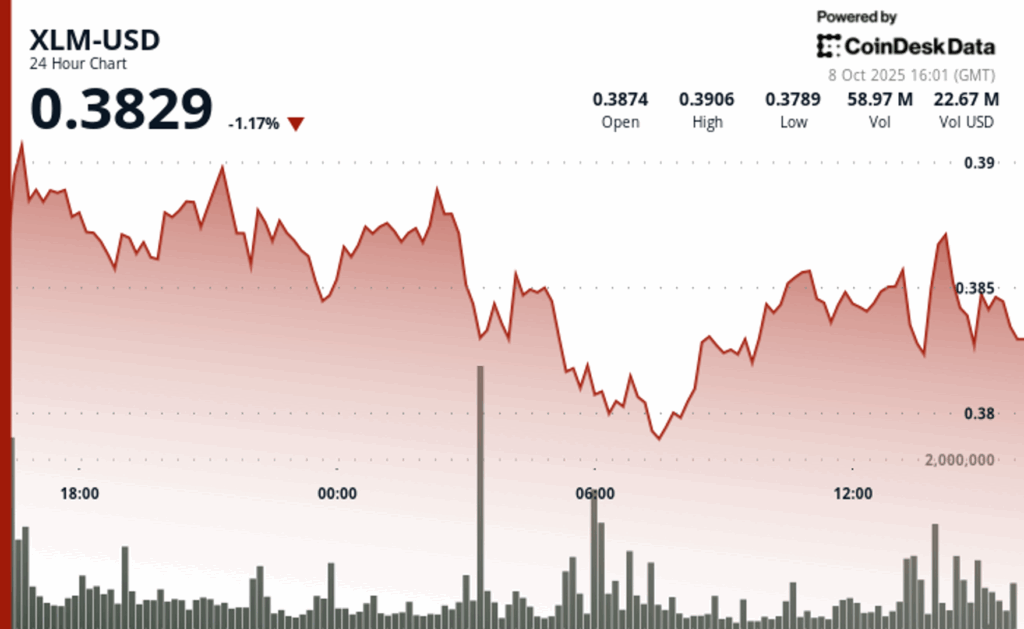

Stellar’s native token XLM experienced heightened volatility over the past 24 hours, fluctuating between $0.38 and $0.39 — a 3% range — before closing near session highs. After dipping to $0.38 early on Oct. 8, the asset mounted a swift recovery, regaining ground above $0.39 by the end of the period, suggesting robust buying activity at lower levels.

During the most recent hour of trading, XLM again demonstrated pronounced short-term swings, plunging briefly to $0.38 before rebounding sharply to reclaim the $0.39 mark. This intraday reversal underscores a strong recovery pattern, hinting at increasing market momentum and potential continuation of the upward trajectory.

Institutional activity appears to be reinforcing Stellar’s resilience. Open interest has climbed beyond $300 million, reflecting rising participation from professional traders and funds. As an ISO 20022-compliant cryptocurrency, XLM is seen as strategically positioned for upcoming Fedwire and SWIFT upgrades in 2025 — a narrative driving institutional confidence in the network’s role in global payments.

Sustained accumulation around $0.38 suggests that large buyers are taking advantage of temporary pullbacks, with surging volumes confirming renewed interest in Stellar’s cross-border payment infrastructure. Consolidation near $0.40 signals the market’s growing conviction that XLM’s recovery could extend further as payment-focused digital assets gain mainstream traction.

Technical Indicators Signal Bullish Momentum

- Volume analysis reveals heightened selling pressure during the early morning hours of 8 October, with trading activity culminating at 52.49 million during the 06:00 hour, considerably above the 24-hour average of 27.43 million.

- Robust volume support established around the $0.38-$0.38 zone during the decline phase.

- Volume surges during decline phases, particularly the 1.54 million surge at 13:28 and subsequent high-volume periods, confirmed institutional accumulation at reduced levels.

- Quintessential support and resistance dynamics emerged with substantial purchasing interest around the $0.38-$0.38 zone.

- Sustained upward momentum concluded with XLM achieving new session peaks proximate to $0.39.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Pantera Backs TransCrypts with $15M Seed Round to Expand Blockchain Identity Platform

The funds will be used to expand the company’s credential verification system beyond employment into healthcare and education.

What to know:

- Pantera Capital has led a $15 million seed round for TransCrypts, joined by Lightspeed Faction, Alpha Edison, and other investors.

- The company plans to extend its blockchain credential platform to health and education records following its HIPAA certification.

- TransCrypts recently won CoinDesk’s Pitchfest at Consensus Hong Kong, earning $10,000 in tokens, a trophy, and ten mentoring sessions.