Whales and mid-tier wallets increased their holdings, indicating accumulation as the price forms an ascending triangle.

Updated Oct 6, 2025, 5:20 a.m. Published Oct 6, 2025, 5:20 a.m.

Dogecoin weathered early volatility before settling into a tight band, with institutional flows anchoring support near $0.251. Whales and mid-tier wallets boosted holdings, signaling accumulation as technical patterns compress into an ascending triangle. Traders are now watching if $0.25 can harden into a launch base toward $0.27–$0.30.

News Background

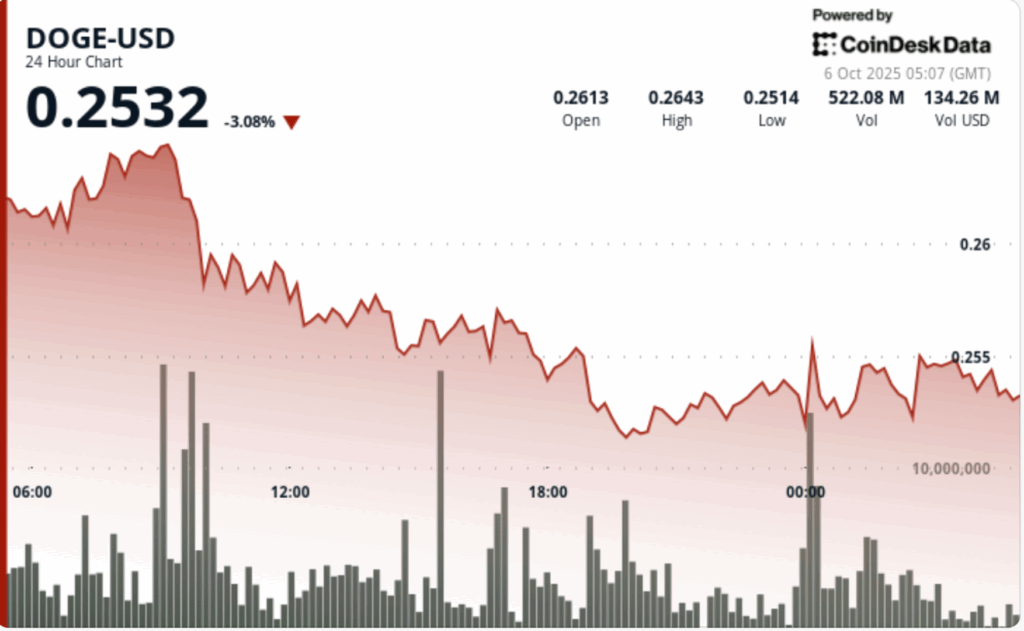

DOGE traded a 5.3% range in the 24 hours to Oct. 6, 03:00, moving between $0.265 and $0.251. The token opened at $0.258, rallied briefly to $0.264, then faded into afternoon selling pressure.

By late session, support held firm in the $0.251–$0.252 zone as buying interest stabilized price near $0.254. On-chain data showed mid-tier wallets added 30M DOGE, lifting their combined holdings to 10.77B tokens, while top 1% addresses now control over 96% of supply.

Price Action Summary

- DOGE swung through a $0.014 corridor, peaking at $0.265 and bottoming at $0.251.

- Afternoon selloff dragged price lower, but $0.251–$0.252 support held on sustained buying.

- Late trading stabilized price at $0.254, hinting at floor formation.

- Final 60 minutes saw a selloff to $0.2540 followed by a modest rebound, with volumes averaging 5.2M and spiking to 33.1M during liquidation.

Technical Analysis

- Key support is anchored at $0.251–$0.252, where buyers repeatedly defended dips. Resistance sits at $0.265, with profit-taking stalling advances.

- The structure reflects tight consolidation inside an ascending triangle, confirmed by accumulation signals.

- On-chain metrics suggest positioning is shifting toward large holders, reinforcing the bullish setup. A decisive move above $0.265 could trigger targets in the $0.27–$0.30 zone.

What Traders Are Watching?

- If $0.25 continues to hold as the structural floor into U.S. hours.

- Whether whales extend accumulation beyond the 30M tokens added this session.

- A breakout attempt above $0.265 to open path toward $0.27–$0.30.

- The impact of concentrated supply (96% with top holders) on volatility around breakout levels.

More For You

Total Crypto Trading Volume Hits Yearly High of $9.72T

Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

What to know:

- Combined spot and derivatives trading on centralized exchanges surged 7.58% to $9.72 trillion in August, marking the highest monthly volume of 2025

- Gate exchange emerged as major player with 98.9% volume surge to $746 billion, overtaking Bitget to become fourth-largest platform

- Open interest across centralized derivatives exchanges rose 4.92% to $187 billion

More For You

Figure Gets Mixed Wall Street Debut as KBW, BofA Diverge on Outlook

The newly public blockchain lender earns praise for market share in tokenized credit, but concerns remain over scaling and regulation.

What to know:

- KBW initiated coverage of Figure with an “Outperform” rating, citing dominance in tokenized credit markets and upside beyond HELOCs.

- Bank of America issued a “Neutral” rating, pointing to execution risks and overreliance on Figure’s non-blockchain-native HELOC business.

- The $7.50 gap in price targets highlights cautious expectations around Figure’s ability to scale its blockchain lending platform.